This weekend ran into a bit of time and did a review of educated posts on the status of the US economy, China, Europe, crude oil production, foreign currencies and the combined impact of all of the above on crude oil price outlook in the next two quarters. Do you want a quick summary? One word. Sell.

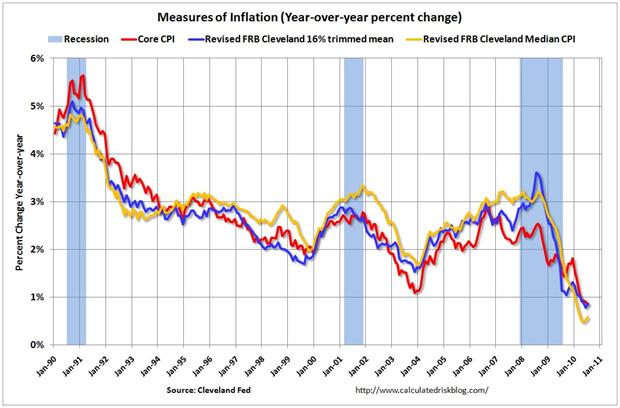

Let’s start with the US economy. While there is raging debates between the left and the right on who is right or wrong, the most objective, backed by data, short and sweet analysis comes through on two posts by Calculated Risk. The first on the sustained downward trend in inflation. Let the picture speak for itself.

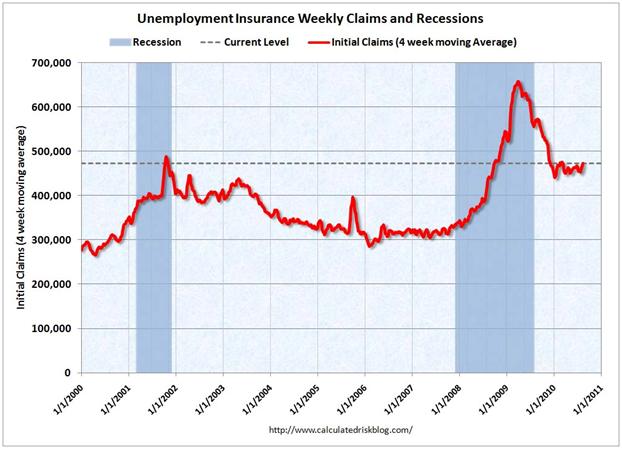

The second on the outlook on the un-employment rate

Both factors are bearish on the US economy, the outlook of fuel consumption and the multiplier effect of both elements on the overall global demand for oil. The talk has now turned from if we will see a double dip to when will we acknowledge the second dip?

But the case is not closed as yet. Here are some interesting bits that will further muddle up the outlook. According to API US gasoline demand in June touched a six year low point, while the UCLA Ceridian index picked up in July and corporate profits are back where they belong in June 2010. The employment rate as per the Economist graph below is leveling off, you need to revisit Calculated Risk‘s argument on a rise in the unemployment rate in the remaining two quarters of 2010.

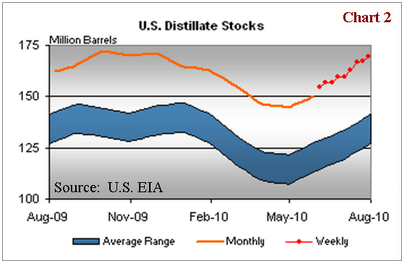

Gregory White at Business Insider has the final word on the outlook on the US economy with his collection of nightmare charts the Fed is looking at right now for the FOMC meeting. Make sure that you walk through the entire slide deck. If there is any doubt, the final nail is the coffin is the dip in US distillate demand and the rise in US distillate inventories further supporting the assumption of a broad based industrial slow down.

Next stop China. Michael Pettis at China Financial Markets shares his take on the Chinese slow down. Once again the outlook points towards a slowdown in Chinese growth figures but much more importantly nullifies any hope of a growth in Chinese domestic demand coming out and saving the world or the oil price outlook.

For the Eurozone, liquidity and funding crisis for small and mid size business sector (take a look at rising Euro Libor and Euribor rates) side by side with European austerity measures will keep demand on the low end for the remaining part of the year.

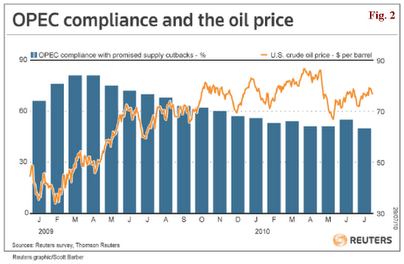

On the production front OPEC Quota compliance stays in the 50% bracket supporting the thesis that the most well informed community on this planet about the state of the global economy and the upcoming price crunch is the OPEC community of Oil ministers from the oil producing club of the world. Otherwise why these guys would be getting in each other’s way to sell all the oil they can sell at currently “depressed” prices. Especially when the “official word” is that anything under 65 should lead to an additional curtailment of crude oil production.

Crude Oil going higher? With this slew of news, analysis and coverage, not any time soon. Remember the word. Sell!