Nauman Khan at InvestBank wrote a note on the relative change in US crude oil inventory on a seasonally adjusted basis when I asked him if the increase in US stock pile was simply a run up to refineries gearing up for their summer production run.

Here is what Nauman’s note says:

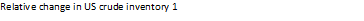

The figure above shows the relative change in US crude inventory stock pile on a year on year basis. The horizontal axis shows the month of the year, the vertical the relative percentage change and the lines the actual crude oil inventory levels for a given year.

Using the last five years data as a benchmark, inventories always rise in the early part of the year and carry on rising till May. They rose in the early part of 2008 (pre crash) and in 2009 (post crash) and they have risen at a much slower pace in the 2010; as slow as the rise in first quarter 2006 and 2007. So while the actual rise has led the expected rise, the rise is still lower than 2008 and 2009 numbers.

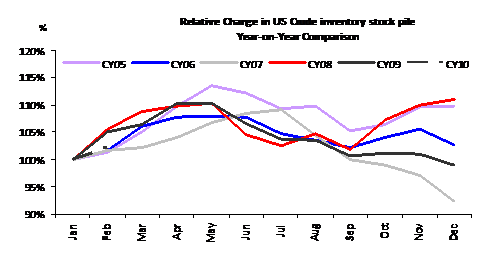

In isolation this may not mean a lot but when you compare that with WTI contract volumes also on a seasonal basis you notice the spike in Feb 2010. It is about 100,000 barrels higher than the average of the last three Marchs (2007, 2008, 2009). Someone has been buying oil.

More later.