A.1. Overview

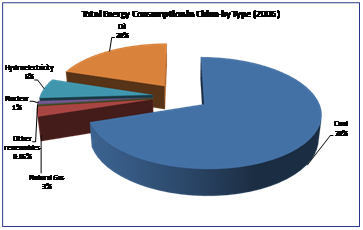

Despite the economic downturn in 2007, which saw China’s GDP growth decline by more than half from around 13% in 2007 to around 6% in the first quarter of 2009, its demand for energy remains high. In 2006 China was the world’s third largest net importer of oil which is in stark contrast to the fact that it used to be a net exporter of this product in the 1990s. Natural gas consumption has also increased over the years- and China has sought to increase imports of this energy source via pipelines and liquefied natural gas (LNG). China remains the world’s largest producer and consumer of coal, which in 2006 accounted for more than 70% of domestic consumption. It has tried to diversify its energy supplies into hydroelectricity, natural gas and nuclear power, but these sources still remain relatively small in its energy consumption mix.

A.2. Oil

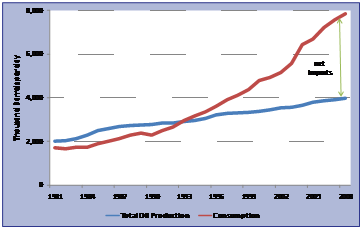

China is the second largest consumer of oil products in the world. Consumption for the year 2008 was 7.8 million barrels per day. It produced around 4 million barrels per day of total oil liquids while it imported approximately 3.9 million barrels per day. Most of the oil produced (96%) is crude oil. According to the EIA total oil consumption is expected to grow through 2009 and 2010 and is expected to reach a demand level of 8.2 million barrels per day in 2010. On the other hand it is forecasted that the production levels will remain relatively unchanged. Current proven oil reserves according to the Oil and Gas Journal stand at around 16 million barrels as of January 2009.

The government’s energy policies are dictated by this ever growing demand for oil and oil products. National oil companies like the China National Petroleum Corporation (CNPC), its publicly listed arm Petro China and China Petroleum and Chemical Corporation (Sinopec) have significant clout in the market accounting for a major share of the total oil and gas out put and revenues. Additional state-owned companies have also emerged in recent years, notably the China National Offshore Oil Corporation (CNOOC) which has become a major competitor to CNPC and Sinopec particular in the area of offshore exploration and production.

In December 2008, the government introduced pricing reforms in the market in the form of a fuel tax and a product pricing mechanism that would tie China’s retail oil product prices more closely to that of the international crude oil market. This move also aimed to attract investment in more downstream activities like refining and distribution, increase the revenues/ maintain profit margins of the refineries and avoid supply breakdowns and subsequent financial losses to the refineries that had resulted in the past due to artificial price caps and other price distortions that were witnessed when international prices skyrocketed in mid 2008. A direct result of these reforms has been four increases in fuel prices in this year alone. Most recently China raised both gasoline and diesel prices by 300 yuan a ton on 2nd September to reflect the rise in international crude oil prices and to help its refiners offset the increasing costs of raw-materials.

85% of China’s oil production capacity is based onshore though offshore E&P has been gaining ground at recent times particularly in the areas of Bohai Bay and the South China Sea. Recent onshore exploration has been focused in the western interior provinces of Xinjiang, Sichuan, Gansu and Inner Mongolia. In view of its growing dependency on oil Chinese national oil companies are also seeking interests in overseas E&P projects. They have negotiated a number of loan-for-oil deals with several countries this year, including Russia, Brazil, Venezuela, Kazakhstan, Ecuador and Turkmenistan amounting to around US$ 50 million. In addition to these deals these companies are also seeking investment opportunities in Iran, Iraq, Syria and Latin America as China expands its refining capacity to accept sour and high-sulphur crude oil. Besides E&P projects China has also negotiated a number of pipeline deals as well, in particular with Kazakhstan and Russia. Middle Eastern countries, particularly Saudi Arabia, were the major source of oil imports for China. African countries, like Angola, are also significant sources.

A.3. Natural Gas

In 2007 for the first time in 20 years China became a net importer of natural gas. Most recently PetroChina entered a US $41 billion 20-year deal with Australia to buy natural gas from them from the yet-to-be developed Gorgon gas field off Australia’s far northwest coast.

In the past natural gas did not have a prominent share in China’s consumption mix, but it is anticipated that in the coming years the demand for natural gas and hence its import of this product (principally in the form of LNG) is likely to gradually grow. EIA forecasts that by 2030 the demand for natural gas is likely to triple. This increase in demand is primarily due to China’s commitment to alleviate high pollution levels resulting from its high levels of coal usage. The government plans to increase total energy consumption share of natural gas up to 10% by 2020. Also, in contrast to the past where the main consumer was the industrial sector, consumption among the power sector and residential and commercial users has increased and is expected to continue to do so.

National oil companies CNPC, Sinopec and CNOOC are the prominent players in this market. CNPC alone accounts for 75% of the country’s total natural gas output. China’s primary gas producing regions are the Sichuan, Shaanganing Provinces, the Xinjiang Uygur Autonomous Region and Qinghai which produce 65% of China’s total gas output. In addition there are many offshore natural gas fields in the Bohai Basin and South China Sea.

Natural gas prices are controlled by the government though they tend to vary by region, industries and even users. On average they are half of international natural gas prices. However, the government, through its energy regulator, the National Energy Administration (NEA), intends to introduce price reforms as in the case of oil prices that would tie the prices to those available on the international market. Analysts anticipate a price hike in September as the first arrival of pipeline gas (costing double local prices) is expected from central Asia by November. The extent of the hike is not expected to be as dramatic as that of fuel prices as it is generally believed that the government would be careful not to impede the expansion of the growing demand for this product. The increase would be to the extent that it would encourage producers to expand supplies as well as encourage industries to continue usage regardless of the higher price.

A.4. Coal

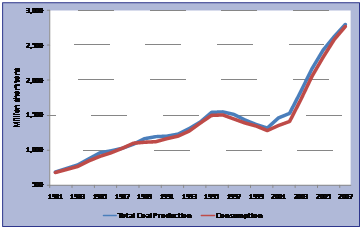

Coal is the principal energy source in China accounting for 70% of total consumption. It is both the largest producer as well as the consumer of this energy product in the world. In 2008 consumption stood at 3 billion short tons of coal which is 40% of the world’s total coal consumption. Consumption has been on the rise since 2000, reversing an earlier declining trend. Principal consumers are the industrial and power sectors.

Most of the production is carried out in Northern China as the coal from this region is more easily accessible. Producers include large state-owned coal mines, local state-owned mines and thousands of town and village mines. The latter smaller mines account for a significant portion of the market but they are inefficiently run and cannot easily respond to market demand.

China aims to consolidate the industry so as to raise output, attract more investment and new technology and improve the safety and environmental record of coal mines. It has also begun to look towards opening foreign investment to this sector particularly in promoting newer technologies like coal liquefaction, coal bed methane (CBM) production, and slurry pipeline transportation projects.

Imports of coal by China have started to increase from 2002 primarily because imported coal prices became competitive as compared to domestic production prices and also because domestic production tends to occasionally suffer from supply disruptions. According to some projections it is expected that in the next five to ten years China could become a net importer of coal.

(Sources & Reference: Energy Information Administration)